The purpose of the Purchase, Invoice, and Non-Travel Reimbursement form is to request the purchase of goods or services, the payment of a vendor invoice, and the processing of a non-travel reimbursement to be processed by the Executive Office Finance team (EOFin).

Submission of the request will create an RT ticket sent to the EOFin team. Please include all documents related to the request. Additional information or approval may be requested/required based on the request. Please fill out the form to the best of your knowledge.

Documentation

Prior to filling out this form, please have the following documents that are applicable to your request ready and prepared for upload (not all documents are applicable/required for every individual).

Purchase, Invoice, and Non-Travel Reimbursement form

Notice: Effective March 7, 2025, all travel and training requests will be reviewed and approved by a Dean, Chancellor (or designee), or Cabinet-level official to be deemed essential. “Pre-Travel Approval” requests will now route for approval according to the Executive Office Finance

Pre-Travel Approval Flow.

The purpose of the Travel Reimbursement form is to submit a University of Washington business travel reimbursement request to be processed by the Executive Office Finance team (EOFin).

Submission of the request will create an RT ticket sent to the EOFin team. Please include all documents related to the business travel reimbursement. Additional information or approval may be requested/required based on the business travel reimbursement request. Please fill out the form to the best of your knowledge.

Documentation

Prior to filling out this form, please have the following documents that are applicable to your request ready and prepared for upload (not all documents are applicable/required for every request)

- Itemized receipts

- Itemized documentation

- Pre-travel approval form

- Car rental agreement

- Perjury statement (if you are missing receipts for expenses over $75)

- Comparison airfare documentation*

*If you are requesting reimbursement for airfare that includes personal time you must include a comparison airfare.

Travel Reimbursement form

Overview of Unit Financial Reports:

This page provides financial reports for the following units:

- Academic and Strategic Affairs

- Academic Personnel and Faculty

- Division of Campus Community Safety

- Environmental Health and Safety

- Health Sciences Services

- Internal Audit

- Office of Shared Governance

- Strategic Initiatives Office

Unit financial reports are prepared by using data from multiple reports and sources. They give an overview of each unit’s budgeted, actual, and projected activity to help with financial decision-making.

The reports are made available to unit heads and those they designate, at their discretion, to view the unit financial reports. Designated individuals will have received guidance from the Executive Office on reading the reports.

Report Posting Schedule

The unit financial reports for fiscal year 2026 will be available on a monthly basis, rather than quarterly, beginning in October 2025.

Fiscal Year 2026 Report Schedule

FY2026: July 1, 2025 – June 30, 2026.

| Month Closes |

Report Expected |

| End of September 2025 |

End of October 2025 |

| End of October 2025 |

End of November 2025 |

| End of November 2025 |

End of December 2025 |

| End of December 2025 |

End of January 2026 |

| End of January 2026 |

End of February 2026 |

| End of February 2026 |

End of March 2026 |

| End of March 2026 |

End of April 2026 |

| End of April 2026 |

End of May 2026 |

| End of May 2026 |

End of June 2026 |

| End of June 2026 |

End of July 2026 |

Unit Financial Reports

Unit reports are accessible only by designated individuals and require UWNetID login. The following links will redirect you to SharePoint where the unit financial reports are stored. If you are designated, you should have immediate access to the reports. If you cannot access the reports on SharePoint, and believe this is an error, please contact Kelly Shimizu, Executive Office Associate Director of Finance & Business Operations.

Support Contact

Contact Kim Dinh, Executive Office Senior Director, for questions regarding your unit financial report.

Billing

Every month, internal and external billing data is submitted to EO Fin by the units in the Executive Office that provide goods or services to other UW units and departments. This data must be provided within ten days after the end of each month.

Rates

Billing rates are fees charged for goods or services provided by an EO unit to another UW department or unit.

EO units should work directly with the Executive Office Senior Director and Associate Director of Finance & Business Operations for updating, reviewing, and approving all recharge centers, service centers, and student fees. Billing rates must be reviewed and approved annually. Additional approval may also be required by UW Management, Accounting & Analysis (MAA).

A contract establishes the terms & conditions for a standing order of goods/services over a period and involves multiple invoices.

Contracts were formerly referred to as a blanket purchase order (BPO).

EO Finance Assistance

Involve EO Finance (EOFin) in the contract process as early as possible, through the Contract Initiation Form. Additionally, if you would like assistance with or have questions about the required procurement services signature, sole-source justification, scope of work (SoW), Data Processing Agreement (DPA), etc., submit an EOFin Consultation request.

Contract Requirements

Procurement Services Approval

All procurement contracts, regardless of the dollar amount, must be signed by UW Procurement Services prior to purchase.

Sole Source Justification

- Sole-Source Justification explains why only one supplier is suitable for a purchase, shows the decision is fair and in the University’s best interest.

- A Sole-Source Justification is required when the purchase is expected to be above the direct buy limit ($10,000 including shipping and handling but excluding tax).

Quote or Scope of Work (SOW)

A Quote or Scope of Work (SOW) outlines the project’s timeline/schedule, the budget, the goals, and outcomes expected from establishing the contract and is always required.

Data Processing Agreement (DPA)

- A Data Processing Agreement (DPA) is an agreement between the University of Washington and a supplier to establish how information and data is handled. A DPA is created to protect personal data maintained by the University.

- A DPA is required when sensitive data is being accessed by the supplier.

Contract Extension

To request an extension of an already existing contract, review the Contract Extension information and then submit the Contract Extension form.

Notice: Beginning March 7, 2025, non-local travel and training requests will be routed to a Dean, Chancellor (or designee), or Cabinet-level official for their review and determination of essential travel. The updated Executive Office Finance

Pre-Travel Approval Flow has been designed to reflect this change and help guide requests through the appropriate channels.

The University of Washington reimburses travelers for business-related, essential travel expenses. Travelers must follow University travel policies.

Executive Office travelers must follow the guidelines, policies, and best practices provided on this webpage.

EOFin is here to help make your travel experience as smooth as possible and to support you along the way.

Critical UW Business Travel Reminders

While this section covers the critical details, EOFin highly recommends you read the remainder of the webpage as in-depth details on these topics and other important items are included.

Critical UW Business Travel Reminders

Do not book any travel or incur any travel-related expenses prior to your trip being approved. Anything booked without approval is not guaranteed to be reimbursed.

More information is available in Submit Travel Approval.

Comparison airfare must be provided for any trip that includes personal time.

EOFin best practice is to acquire comparison airfare BEFORE the trip has occurred. If not obtained before the trip, please reach out to EOFin.

More information is available in Book Airfaire.

Please retain all ITEMIZED receipts and documentation related to business expenses made before and during business travel.

Meal Receipts: Itemized receipts are typically not needed for the traveler’s claimed meals.

More information is available in Maintain Necessary Documentation.

Ride Shares (Uber, Lyfts, etc.) must utilize “Standard” ride options. Any upgrades are not guaranteed to be reimbursed.

More information is available in Ground Transportation Policy.

The Rental Car class charged on the final agreement can be up to a full-size sedan. Any class higher than full-size requires business justification.

More information is available in Ground Transportation Policy.

Pre-Travel Steps

Travel booked for a non-UW employee requires assistance from EOFin staff. Contact EOFin via the consultation form.

Pre-Travel Steps

Travelling outside of Washington state for Executive Office business requires a Pre-Travel Approval form. This must be submitted and approved before your trip. The form can be submitted by you or someone else on your behalf.

For travel within Washington state, refer to the Local Travel section.

After the Pre-Travel Approval request is approved, EO Finance will follow up with airfare booking instructions based on your travel details.

Personal Time: For travel that includes personal time during the trip, you must secure comparison airfare documentation at the time of booking. EO Finance will include instructions for this in their follow-up message.

After the Pre-Travel Approval request is approved, EOFin will confirm the approved daily (per diem) lodging rate when responding to the ticket. Rates are determined by dates and location of travel. After this, the traveler then must book their lodging using personal funds and staying within the confirmed rate(s).

At the time EOFin confirms the rate, you can discuss if you believe you qualify for an exception to the rate. You may ask them to send you a list of eligible exceptions.

During Travel

During Travel

To complete the Travel Reimbursement form after your travel, the following documents may be required. Certain documents apply depending on each traveler’s purchases and circumstances.

- Pre-Travel Approval request form: Out-of-state travel is defined as travel outside of Washington. All out-of-state travel, including event registration, MUST be pre-approved by the appropriate parties using the Pre-Travel Approval form.

- Finalized Car Rental Agreement: More information in the Ground Transportation section.

- Google map route (screenshot): A screenshot of the route traveled clearly stating the starting and ending location (mileage being clearly indicated)

- Comparison Airfare Documentation: Only needed if taking personal time and personal funds were utilized for purchasing

- Itemized Documentation including:

- Lodging Folio

- Ride Shares / Car Services – For guidance on best practices, please refer to the Ride Share information

- Meals Paid for Others

- Baggage Fees

- Parking Fees

- Other Purchases – Applies to items purchased while in travel status such as office supplies, postage, shipping expenses, etc.

Documenatation for Other Purchases: This list covers commonly purchased items. However, there may be additional documentation needed depending on each traveler’s purchases and circumstances.

Ground transportation includes driving your own car, using a ride hailing service (e.g., Uber or taxi), or renting a vehicle. This section explains the policies for these options and what types of commutes are considered part of official travel.

Allowable/Reimbursable Ground Transportation Commutes:

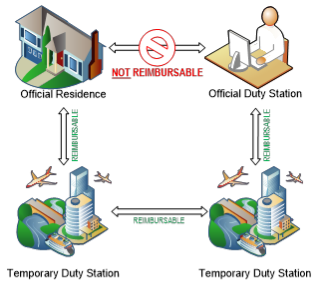

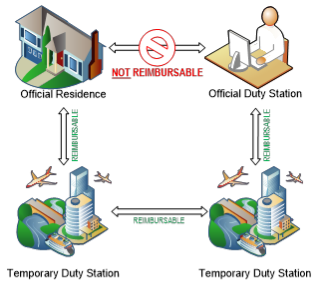

When determining if a commute is reimbursable, it is important to understand how the University defines business locations. Please review the definitions and then the information on the allowable and unallowable routes.

Official duty station

Traveler’s primary physical address of work (e.g. UW Seattle Campus building). Any location where the traveler will be working on an ongoing basis lasting or expected to last longer than 1 year MUST be considered an official duty station.

Official residence

Traveler’s primary physical address of residence. This should be the address that’s been officially reported to the University for tax purposes.

Temporary duty station

Any physical address location assigned on a temporary basis lasting for or expected to last less than one year may be assigned as a temporary duty station. Any location where the traveler will be working on an ongoing basis lasting or expected to last longer than one year MUST be considered an official duty station.

Reimbursable route(s), including non-scheduled workdays:

- From Official Residence (Home) to Temporary Duty Station

- From Official Duty Station to Temporary Duty Station

- From Temporary Duty Station to Official Residence (Home)

- From Temporary Duty Station to Official Duty Station

Non-reimbursable routes, including scheduled and non-scheduled workdays:

- From Official Residence (Home) to Official Duty Station

- Official Duty Station to Official Residence (Home)

- Parking at Official Duty Station

Ride Share

A ride share is any trip that a traveler takes in an Uber, Taxi, Lyft or any other ride-hailing service. Travelers are limited to the service provider’s standard class.

Tips for car service are reimbursable. Any additional charges or upgrades purchased for personal convenience are not reimbursable. This includes Priority Pickup Upgrade Fees, Wait Time Fees, and Car Service types that are not the standard “UberX” or “Lyft”.

Car Service Upgrade: Due to driver availability, booking a standard Uber or Lyft is not always possible. If that is the case and you would like to be reimbursed, you will need to provide a signed Approval for Car Service Upgrades form. Questions on allowable upgrades or who needs to sign the form can be sent via the consultation form.

Car Rental

UW allows reimbursement for car rentals up to a full-size sedan. To claim reimbursement, the final itemized rental agreement is required. Any class higher than a full-size sedan will need to be justified by the traveler, to EOFin, to receive reimbursement.

We’ve answered a few of the most frequently asked questions about this topic. Additional questions can be addressed via the consultation form.

What meal costs are allowed while traveling? (Or, what is the “Meals per Diem” policy?)

Meal costs during travel are reimbursed using a daily allowance, called a per diem. The amount you can claim depends on your travel times and destination. You can only be reimbursed up to the allowed per diem amount.

After your Pre-Travel Approval request is submitted, your EOFin contact will help confirm the meal per diem rates for your trip.

At what point of my trip do meals start/stop counting as reimbursable?

Entering travel status is the time you begin to travel. That time determines the first meal you can claim.

| Time You Begin Travel |

Reimbursable Meals |

| Before 8:00 A.M. |

Breakfast, Lunch, Dinner |

| Between 8:00 A.M.-2:00 P.M. |

Lunch, Dinner |

| Between 2:00 P.M.-6:00 P.M. |

Dinner |

| After 6:00 P.M. |

No meals reimbursed |

Exiting travel status is the time you come to the end of your travels. That time determines the last meal you can claim.

| Time You Return from Travel |

Reimbursable Meals |

| Between 6:00 A.M.-12:00 P.M. |

Breakfast |

| Between 12:00 P.M.-6:00 P.M. |

Breakfast, Lunch |

| After 6:00 P.M. |

Breakfast, Lunch, Dinner |

When can I arrive at the airport for UW travel and start meal reimbursements?

Per UW Travel policy, it is allowable to arrive at the airport up to three hours before domestic flights and up to four hours before international flights.

To request additional assistance to determine what meals are allowed based on travel start and end times, you may respond to the ticket that was created when the Pre-Travel Approval request was submitted and approved. Or, you may submit an inquiry via the consultation form.

Local Travel FAQs

Frequently Asked Questions about local travel – within Washington state.

Local Travel FAQs

No. Local travel is considered travel within Washington state. Travel to Oregon or Idaho is considered out-of-state travel and requires a Pre-Travel Approval.

You can be reimbursed for ground transportation costs between your official duty station and temporary work location. This includes mileage, ride shares, parking fees, and similar expenses.

Example: Traveling from Schmitz Hall to the Seattle Convention Center for a conference or UW business meeting qualifies for reimbursement.

You may be reimbursed for meals during travel if you meet both of the following conditions:

- You travel more than 50 miles away from both your home and your regular work location (using the most direct route).

- You meet the 11-hour rule for same-day trips.

If you do not meet both, you do not qualify for meal reimbursement. If you think you qualify for an exception to either of these conditions, submit an inquiry via the consultation form.

For details on how travel distance and the 11-hour rule work, refer to the 50-Mile and 11-Hour sections.

One of the requirements to qualify for meal reimbursements is that your travel must be more than 50 miles away from both your home and your work location, measured by the most direct driving route.

Example:

- If your home is in Tacoma and your work is in Seattle, traveling to Olympia (about 35 miles from Tacoma) would not qualify because it is less than 50 miles from home, even if it is over 50 miles from work.

- If your home is in Tacoma and your work is in Seattle, traveling to Spokane would qualify since it is more than 50 miles from both home and work.

The 11-hour rule is a policy that states your total travel time on a same-day trip must be at least 11 hours to qualify for meal reimbursement. This is one of the requirements you must meet for meal reimbursement.

To determine your total travel time, add together:

- The time spent commuting to your temporary work location (using the most direct route).

- The time spent working there (excluding meal breaks).

- The time spent commuting back home.

If the total is 11 hours or more, you meet the rule. If it is less than 11 hours, you do not qualify for meal or lodging reimbursement.

This applies to UW guests traveling locally. Someone from the department they are traveling on behalf of must notify EOFin via the consultation form prior to any travel. EOFin will determine appropriate next steps based on the specific situation.

Post-Travel Checklist

Applies to all travel. Submitting your documentation on time helps your request get processed quickly and prevents loss of documents or receipts.

- Gather all required documentation and itemized receipts from your trip.

- Complete the Travel Reimbursement form within two months of your travel end date.

The following purchase and reimbursement policies and procedures are for the Executive Office. This guidance is for making purchases or requesting reimbursement that are unrelated to travel. Travel-related information can be found on the EO Finance Travel webpage.

Purchasing & Reimbursement Guidance FAQs

Purchasing & Reimbursement FAQs

You must submit the Purchase, Invoice, and Reimbursement form prior to making any of the following purchases, if you will be seeking reimbursement:

- Prizes or awards for UW employees or students.

- Gift certificates for employee recognition.

- Items purchased with personal rewards – e.g., Amazon or Costco rebates, mileage points, credit card travel rewards, or gift cards.

- Purchases over $10,000.

- Computer or security hardware.

Whenever possible, items and services should be purchased using one of the following methods:

- UW catalog or non-catalog order

- Supplier invoice

- EOFin ProCard

All purchases must:

- Serve a clear UW business purpose

- Include a brief justification (who, what, when, where, and why)

Allowable Purchase Types

Meal or food purchases are allowed only for the following event types:

- Meeting – Official UW work meetings requiring food to support functionality.

- Training – UW-sponsored training sessions where food supports learning objectives.

- Recognition – Events recognizing UW employees. (See the recognition purchase (link to recognition purchases section) for details.)

Required Steps

1. Complete the UW Food Form

- a. The UW Food Form [PDF] must be signed by the appropriate approver (see approver matrix – linked).

- b. Submit completed form to EOFin via the Document Upload form before any purchase is made.

2. Determine the Expense Limits

- a. Light refreshments: Capped at $10–$12 per person. The Food Form limit is the maximum allowable.

- b. Meals: Must stay within the approved UW daily meal (per diem) rate, inclusive of tax, gratuity, and delivery. EOFin will confirm the rate in their response to your Purchase, Invoice & Reimbursement form request ticket. If you do not submit a request form, you may contact EOFin via EOFin General Consultation form to confirm the applicable rate.

3. Submit Purchase Request

Discretionary Funds: Standard limits may not apply when using discretionary funds. Contact EOFin to ensure funds are available and the purchases qualify.

Units must have a formal recognition policy on file to purchase gifts or food for employee recognition.

To confirm whether your unit has a recognition policy or to establish one, contact Terry Wilson, EO Associate Director of Employee Relations.

Recognition meals

- Only expenses for the individual(s) being recognized are eligible.

- All purchases must follow the food purchasing steps outlined in the Food, Catering, and Meal Purchases section.

To engage a new vendor, submit an EO Finance General Consultation form. EOFin will assist in setting up the vendor in the UW Supplier Community and ensuring they can be paid appropriately.

Contact EOFin for new vendor contracts or documents. You must not sign vendor documents yourself.

ProCard requests must be reviewed and approved by the Senior Director. If approved, EOFin will provide policy and usage guidance. Adherence to these policies is required.

For further questions or guidance, submit an EO Finance General Consultation form.

If you are missing a receipt, contact EOFin via the EO Finance General Consultation form as soon as possible. You may be asked to complete an additional form or process, which EOFin will guide you through.

You must provide an itemized receipt when you submit the Purchase, Invoice, and Reimbursement form. If unavailable, include supporting documentation such as:

- Bank statement showing the charge

- Email confirmation of the purchase

- Packing slip

- An itemized list from the vendor

All receipts or supporting documents must include:

- Vendor name

- Description of the purchase

- Amount paid

- Date paid

The Executive Office Finance team (EO Fin) provides comprehensive local guidance, consultation, and financial support to all EO units. EO Fin works in partnership with UW central partners to ensure compliance with University, state, and federal financial requirements.

EO Fin Responsibilities

- Offering local guidance and consultation on finance and business processes

- Supporting units with budgeting, procurement, travel, and reporting

- Ensuring compliance with state, federal, and University financial policies

- Promoting best practices for internal financial operations

By partnering with EO Fin, your unit can ensure that it is following the best financial practices and aligning with University standards.

Explore Finance

All EO Fin Form

EO Finance request forms for contracts, purchases, travel, general consultation and document uploads.

Find an EO Fin Form

Contracts

Guidance on EO contracts, including initiation, approvals, and required documentation.

Learn about Contracts

Purchase & Reimbursement

Guidance on policies and procedures for making non-travel purchases and requesting reimbursements, including frequently asked questions.

Purchasing

Invoices

Guidance on EO invoice requirements, submission, and common processing issues.

View Invoices

Travel

EO guidance on University travel policies, pre- and post-travel procedures, local travel FAQs, and support from EO Finance for smooth reimbursement and compliance.

Learn about Travel

Reports

Designated individuals have access to Executive Office unit financial reports, including budgeted, actual, and projected activity, to support financial decision-making.

Unit Financial Report