The University of Washington reimburses travelers for business-related, essential travel expenses. Travelers must follow University travel policies.

Executive Office travelers must follow the guidelines, policies, and best practices provided on this webpage.

EOFin is here to help make your travel experience as smooth as possible and to support you along the way.

Critical UW Business Travel Reminders

While this section covers the critical details, EOFin highly recommends you read the remainder of the webpage as in-depth details on these topics and other important items are included.

Do not book any travel or incur any travel-related expenses prior to your trip being approved. Anything booked without approval is not guaranteed to be reimbursed.

More information is available in Submit Travel Approval.

Comparison airfare must be provided for any trip that includes personal time.

EOFin best practice is to acquire comparison airfare BEFORE the trip has occurred. If not obtained before the trip, please reach out to EOFin.

More information is available in Book Airfaire.

Please retain all ITEMIZED receipts and documentation related to business expenses made before and during business travel.

Meal Receipts: Itemized receipts are typically not needed for the traveler’s claimed meals.

More information is available in Maintain Necessary Documentation.

Ride Shares (Uber, Lyfts, etc.) must utilize “Standard” ride options. Any upgrades are not guaranteed to be reimbursed.

More information is available in Ground Transportation Policy.

The Rental Car class charged on the final agreement can be up to a full-size sedan. Any class higher than full-size requires business justification.

More information is available in Ground Transportation Policy.

Pre-Travel Steps

Travel booked for a non-UW employee requires assistance from EOFin staff. Contact EOFin via the consultation form.

Travelling outside of Washington state for Executive Office business requires a Pre-Travel Approval form. This must be submitted and approved before your trip. The form can be submitted by you or someone else on your behalf.

For travel within Washington state, refer to the Local Travel section.

After the Pre-Travel Approval request is approved, EO Finance will follow up with airfare booking instructions based on your travel details.

Personal Time: For travel that includes personal time during the trip, you must secure comparison airfare documentation at the time of booking. EO Finance will include instructions for this in their follow-up message.

After the Pre-Travel Approval request is approved, EOFin will confirm the approved daily (per diem) lodging rate when responding to the ticket. Rates are determined by dates and location of travel. After this, the traveler then must book their lodging using personal funds and staying within the confirmed rate(s).

At the time EOFin confirms the rate, you can discuss if you believe you qualify for an exception to the rate. You may ask them to send you a list of eligible exceptions.

During Travel

To complete the Travel Reimbursement form after your travel, the following documents may be required. Certain documents apply depending on each traveler’s purchases and circumstances.

- Pre-Travel Approval request form: Out-of-state travel is defined as travel outside of Washington. All out-of-state travel, including event registration, MUST be pre-approved by the appropriate parties using the Pre-Travel Approval form.

- Finalized Car Rental Agreement: More information in the Ground Transportation section.

- Google map route (screenshot): A screenshot of the route traveled clearly stating the starting and ending location (mileage being clearly indicated)

- Comparison Airfare Documentation: Only needed if taking personal time and personal funds were utilized for purchasing

- Itemized Documentation including:

- Lodging Folio

- Ride Shares / Car Services – For guidance on best practices, please refer to the Ride Share information

- Meals Paid for Others

- Baggage Fees

- Parking Fees

- Other Purchases – Applies to items purchased while in travel status such as office supplies, postage, shipping expenses, etc.

Documenatation for Other Purchases: This list covers commonly purchased items. However, there may be additional documentation needed depending on each traveler’s purchases and circumstances.

Ground transportation includes driving your own car, using a ride hailing service (e.g., Uber or taxi), or renting a vehicle. This section explains the policies for these options and what types of commutes are considered part of official travel.

Allowable/Reimbursable Ground Transportation Commutes:

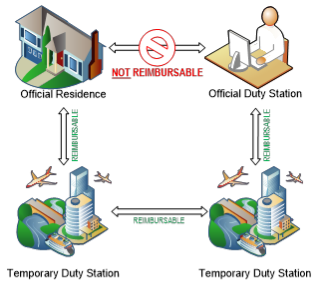

When determining if a commute is reimbursable, it is important to understand how the University defines business locations. Please review the definitions and then the information on the allowable and unallowable routes.

Official duty station

Traveler’s primary physical address of work (e.g. UW Seattle Campus building). Any location where the traveler will be working on an ongoing basis lasting or expected to last longer than 1 year MUST be considered an official duty station.

Official residence

Traveler’s primary physical address of residence. This should be the address that’s been officially reported to the University for tax purposes.

Temporary duty station

Any physical address location assigned on a temporary basis lasting for or expected to last less than one year may be assigned as a temporary duty station. Any location where the traveler will be working on an ongoing basis lasting or expected to last longer than one year MUST be considered an official duty station.

Reimbursable route(s), including non-scheduled workdays:

- From Official Residence (Home) to Temporary Duty Station

- From Official Duty Station to Temporary Duty Station

- From Temporary Duty Station to Official Residence (Home)

- From Temporary Duty Station to Official Duty Station

Non-reimbursable routes, including scheduled and non-scheduled workdays:

- From Official Residence (Home) to Official Duty Station

- Official Duty Station to Official Residence (Home)

- Parking at Official Duty Station

Ride Share

A ride share is any trip that a traveler takes in an Uber, Taxi, Lyft or any other ride-hailing service. Travelers are limited to the service provider’s standard class.

Tips for car service are reimbursable. Any additional charges or upgrades purchased for personal convenience are not reimbursable. This includes Priority Pickup Upgrade Fees, Wait Time Fees, and Car Service types that are not the standard “UberX” or “Lyft”.

Car Service Upgrade: Due to driver availability, booking a standard Uber or Lyft is not always possible. If that is the case and you would like to be reimbursed, you will need to provide a signed Approval for Car Service Upgrades form. Questions on allowable upgrades or who needs to sign the form can be sent via the consultation form.

Car Rental

UW allows reimbursement for car rentals up to a full-size sedan. To claim reimbursement, the final itemized rental agreement is required. Any class higher than a full-size sedan will need to be justified by the traveler, to EOFin, to receive reimbursement.

We’ve answered a few of the most frequently asked questions about this topic. Additional questions can be addressed via the consultation form.

What meal costs are allowed while traveling? (Or, what is the “Meals per Diem” policy?)

Meal costs during travel are reimbursed using a daily allowance, called a per diem. The amount you can claim depends on your travel times and destination. You can only be reimbursed up to the allowed per diem amount.

After your Pre-Travel Approval request is submitted, your EOFin contact will help confirm the meal per diem rates for your trip.

At what point of my trip do meals start/stop counting as reimbursable?

Entering travel status is the time you begin to travel. That time determines the first meal you can claim.

| Time You Begin Travel | Reimbursable Meals |

|---|---|

| Before 8:00 A.M. | Breakfast, Lunch, Dinner |

| Between 8:00 A.M.-2:00 P.M. | Lunch, Dinner |

| Between 2:00 P.M.-6:00 P.M. | Dinner |

| After 6:00 P.M. | No meals reimbursed |

Exiting travel status is the time you come to the end of your travels. That time determines the last meal you can claim.

| Time You Return from Travel | Reimbursable Meals |

|---|---|

| Between 6:00 A.M.-12:00 P.M. | Breakfast |

| Between 12:00 P.M.-6:00 P.M. | Breakfast, Lunch |

| After 6:00 P.M. | Breakfast, Lunch, Dinner |

When can I arrive at the airport for UW travel and start meal reimbursements?

Per UW Travel policy, it is allowable to arrive at the airport up to three hours before domestic flights and up to four hours before international flights.

To request additional assistance to determine what meals are allowed based on travel start and end times, you may respond to the ticket that was created when the Pre-Travel Approval request was submitted and approved. Or, you may submit an inquiry via the consultation form.

Local Travel FAQs

Frequently Asked Questions about local travel – within Washington state.

No. You do not need to submit a Pre-Travel Approval form for travel within Washington State.

No. Local travel is considered travel within Washington state. Travel to Oregon or Idaho is considered out-of-state travel and requires a Pre-Travel Approval.

You can be reimbursed for ground transportation costs between your official duty station and temporary work location. This includes mileage, ride shares, parking fees, and similar expenses.

Example: Traveling from Schmitz Hall to the Seattle Convention Center for a conference or UW business meeting qualifies for reimbursement.

You may be reimbursed for meals during travel if you meet both of the following conditions:

- You travel more than 50 miles away from both your home and your regular work location (using the most direct route).

- You meet the 11-hour rule for same-day trips.

If you do not meet both, you do not qualify for meal reimbursement. If you think you qualify for an exception to either of these conditions, submit an inquiry via the consultation form.

For details on how travel distance and the 11-hour rule work, refer to the 50-Mile and 11-Hour sections.

One of the requirements to qualify for meal reimbursements is that your travel must be more than 50 miles away from both your home and your work location, measured by the most direct driving route.

Example:

- If your home is in Tacoma and your work is in Seattle, traveling to Olympia (about 35 miles from Tacoma) would not qualify because it is less than 50 miles from home, even if it is over 50 miles from work.

- If your home is in Tacoma and your work is in Seattle, traveling to Spokane would qualify since it is more than 50 miles from both home and work.

The 11-hour rule is a policy that states your total travel time on a same-day trip must be at least 11 hours to qualify for meal reimbursement. This is one of the requirements you must meet for meal reimbursement.

To determine your total travel time, add together:

- The time spent commuting to your temporary work location (using the most direct route).

- The time spent working there (excluding meal breaks).

- The time spent commuting back home.

If the total is 11 hours or more, you meet the rule. If it is less than 11 hours, you do not qualify for meal or lodging reimbursement.

This applies to UW guests traveling locally. Someone from the department they are traveling on behalf of must notify EOFin via the consultation form prior to any travel. EOFin will determine appropriate next steps based on the specific situation.

Submit your question(s) via the consultation form; we’re more than happy to help.

Post-Travel Checklist

Applies to all travel. Submitting your documentation on time helps your request get processed quickly and prevents loss of documents or receipts.

- Gather all required documentation and itemized receipts from your trip.

- Complete the Travel Reimbursement form within two months of your travel end date.